Posted on June 10, 2019

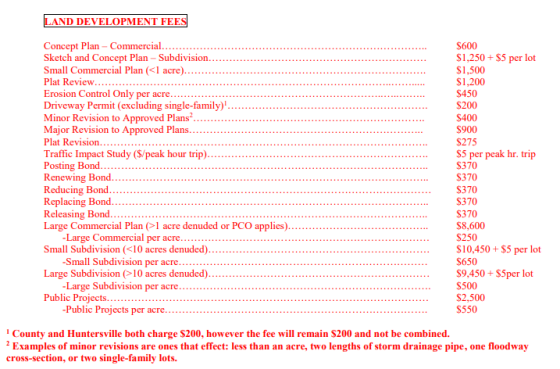

On Monday, June 3, 2019, proposed fee changes were presented to the Cabarrus County Board of Commissioners by the Director of Planning and a consultant that assisted with the fee study. Along with changes in the cost of permit fees, staff is proposing changing new construction permits to a single permit (blanket permits).

On June 19, 2019, Cabarrus County Planning staff is inviting builders to come to an open session from 1-3pm in the Multi-Purpose Room at the Cabarrus County Governmental Center. During this session staff will discuss why these fees are being proposed, give examples of how fees are charged now, and what the fees would be if adopted as proposed. Staff will be able to answer any questions and hear any feedback that you have.

Wednesday, June 19, 2019

1:00 PM to 3:00 PM

Cabarrus County Government Resource Center - Multipurpose Room

65 Church Street S.

Concord, NC 28025

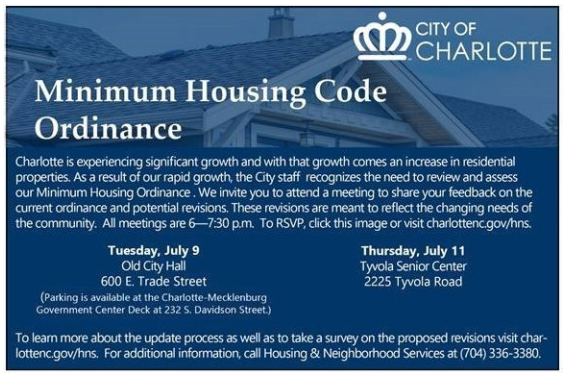

The City of Charlotte is considering revisions to its Minimum Housing Code Ordinance, with changes that could impact housing affordability by raising the cost of property management and code compliance for landlords.

The City of Charlotte is considering revisions to its Minimum Housing Code Ordinance, with changes that could impact housing affordability by raising the cost of property management and code compliance for landlords. NAIOP works with chapters to engage with state leaders on legislative proposals and policies that impact commercial real estate. A key event in many states is a “Day at the Capitol,” which gives members the opportunity to meet state policymakers and discuss important issues.

NAIOP works with chapters to engage with state leaders on legislative proposals and policies that impact commercial real estate. A key event in many states is a “Day at the Capitol,” which gives members the opportunity to meet state policymakers and discuss important issues. Charlotte's planning staff is working on a proposal to amend the City's Tree Ordinance in an attempt to make it easier for urban infill sites to comply. The draft proposal, created through a stakeholder process that included representatives from REBIC, neighborhood groups and environmental advocates, would provide for better integration of trees into small residential and commercial projects, potentially minimizing the need for offsite mitigation. The proposal does not reduce the total amount of trees required on a site, however.

Charlotte's planning staff is working on a proposal to amend the City's Tree Ordinance in an attempt to make it easier for urban infill sites to comply. The draft proposal, created through a stakeholder process that included representatives from REBIC, neighborhood groups and environmental advocates, would provide for better integration of trees into small residential and commercial projects, potentially minimizing the need for offsite mitigation. The proposal does not reduce the total amount of trees required on a site, however.