originally published by JEFF ZBAR for NAIOP National

The years leading up to the pandemic were hot for cold storage. It only promises to grow going forward.

originally published by JEFF ZBAR for NAIOP National

The years leading up to the pandemic were hot for cold storage. It only promises to grow going forward.

originally published by LUCIAN ALIXANDRESCU for NAIOP National

After the initial shock of the pandemic, industrial real estate emerged as one of the asset classes least affected by the ensuing economic downturn. While the causes are multifaceted, the sudden spike in demand for products ordered and curbside pick-up meant that retailers — both online and brick-and-mortar — scrambled to secure the space they needed to fulfill the influx of new orders.

originally published by REBIC with permission to repost on CRCBR.

originally published by JEFF ZBAR for NAIOP National

While some assets in the real estate market have been jolted by pandemic-related fallout, some investors, managers, and property owners will look back on the COVID-19 era as the “golden era” of real estate investment.

While some sectors have struggled, like office and retail, certain sectors have seen tremendous growth. Managers with operational expertise with the right property type have found success.

originally published by ROCHELLE BRODER-SINGER for NAIOP National

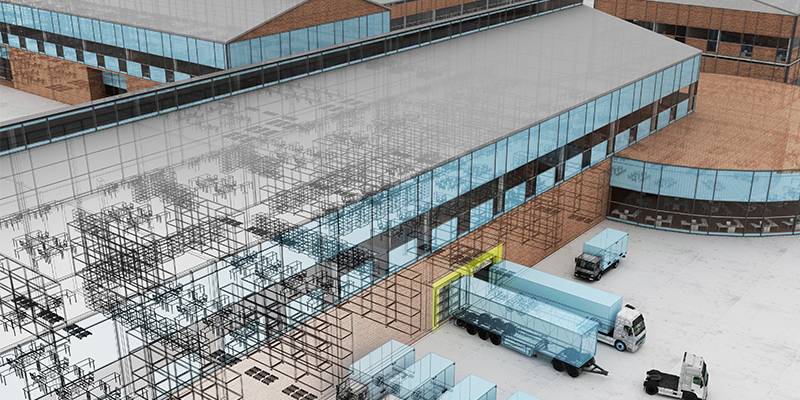

Commercial real estate and construction have been notoriously slow to adopt new technologies. But digital transformation is coming to the industry. At CRE Converge 2021 in Miami Beach, experts discussed how several new technologies are affecting developers, builders, and owners:

Reality capture

originally published by BRIELLE SCOTT for NAIOP National

The post-pandemic construction boom has taken many forms. E-commerce and big box retailers are developing across the country, while at the same time, construction projects that were postponed during the pandemic have resumed. However, the lack of workforce at manufacturing facilities last year combined with the high demand for materials have led to price increases and lead-time delays.

In a session at CRE.Converge this week, a panel of experts led by Bill Finfrock, president, FINFROCK, shared some of the strategies used in construction to keep projects moving forward despite these challenges.

originally published by K.J. Jacobs for NAIOP National

When it comes to choosing the right building, there are several questions an organization must ask itself. Is the company at a place where it can invest in a building that will attract prospective employees? Is the company looking for a more temporary or flexible workplace? Is the facility able to support the organization’s needs for production, research, collaboration or innovation?

Since each company’s requirements, goals and operations are unique, as are each facility’s offerings and characteristics, the answers will vary depending on who’s asking.

Dear NAIOP Chapter Executives:

The NAIOP Research Foundation is currently conducting a brief survey of U.S. members on development costs for office, warehouse/distribution, manufacturing and retail projects. This updated information is needed to complete the 2022 U.S. edition of the Economic Impacts of Commercial Real Estate, and we would appreciate your help promoting the survey to members who are likely to know about development costs for manufacturing and retail properties, as only a few respondents have provided information for these property types.

The survey takes about 2-3 minutes to complete, and we are now offering anyone who provides information on development costs (including those who have already completed the survey) with a $10 Amazon gift card. Please encourage members to complete the survey, either using the personalized link they received on Monday, September 20, or using this open link: https://research.zarca.com/r/hh79EQ If someone else at their firm would be better able to complete the survey or is more familiar with manufacturing or retail projects, members can send them the open link. The survey will now close on October 6.

Originally published for NAIOP

The logistics market is red-hot, but external forces are trying to cool it. A panel at I.CON West this week in Long Beach, California, addressed technical, regulatory and political challenges facing industrial real estate in Southern California, and shared recommendations for all developers working with decision-makers in their communities.

Read the full article here!

Read the full article here!

Investing in sustainable buildings could offer a real solution to reducing emissions in one of the world’s most polluting sectors, said Taronga Ventures, an investment firm focused on sustainable innovation and tech.

Buildings currently represent 39% of global greenhouse emissions, according to U.N. data. Almost one-third (28%) of the global total is the result of running buildings — referred to as operational emissions, while 11% comes from building materials and construction.

Read the full article here!

Read the full article here!

Demand for industrial real estate continues to be strong as the long-term trend toward e-commerce (and away from in-store sales) continues with no end in sight. With nearly 100 million new square feet delivered nationally since the beginning of the year, 450 million square feet currently under construction and another 450 million planned, the demand for industrial real estate still outpaces supply.1

Because of this, authors Dr. Hany Guirguis and Dr. Michael Seiler forecast that the total net absorption in the second half of 2021 will be 162.6 million square feet with a quarterly average of 81.3 million square feet. In 2022, the projected net absorption is 334.6 million square feet with a quarterly average of 83.6 million square feet. An improvement in the outlook for the economy in 2021 and 2022 is behind the upward revision of the 2022 forecast. For example, the real GDP growth rate is now forecast to be 7% in 2021, above the previous forecast of 5% growth. As economic growth is projected to revert toward long-term growth rates in 2023, net absorption in the first half of the year is forecast to be 160.5 million square feet, for a quarterly average of 80.2 million square feet.

Originally published by Hany Guirguis, Ph.D., Manhattan College and Michael J. Seiler, DBA, William & Mary in August 2021

Demand for industrial real estate continues to be strong as the long-term trend toward e-commerce (and away from in-store sales) continues with no end in sight. With nearly 100 million new square feet delivered nationally since the beginning of the year, 450 million square feet currently under construction, and another 450 million planned, the demand for industrial real estate still outpaces supply.1

Because of this, authors Dr. Hany Guirguis and Dr. Michael Seiler forecast that the total net absorption in the second half of 2021 will be 162.6 million square feet with a quarterly average of 81.3 million square feet. In 2022, the projected net absorption is 334.6 million square feet with a quarterly average of 83.6 million square feet. An improvement in the outlook for the economy in 2021 and 2022 is behind the upward revision of the 2022 forecast. For example, the real GDP growth rate is now forecast to be 7% in 2021, above the previous forecast of 5% growth. As economic growth is projected to revert toward long-term growth rates in 2023, net absorption in the first half of the year is forecast to be 160.5 million square feet, for a quarterly average of 80.2 million square feet.

Originally published in NAIOP's Development Magazine Spring 2021 Issue by Ann Moore.

Megaprojects can transform landscapes, improve quality of life and deliver significant economic benefits to their communities. When they are sited on a waterfront in a binational urban area, they take on even more complexity. In Southern California’s San Diego County, a megaproject will transform a formerly blighted stretch of waterfront into a thriving destination. The project team is pursuing innovative ways to reduce the risk that could be instructive to other development teams.

A megaproject is defined by its scale and complexity. Typically costing $1 billion or more, such projects take many years to develop and build, involve multiple public and private stakeholders and impact millions of people, according to the Oxford Handbook of Megaproject Management. A considerable upside also brings great risk, which must be managed to improve the chances of success.

On approximately 535 acres, the Chula Vista Bayfront is larger than Disneyland and one of the last significant large-scale waterfront development opportunities in Southern California. Once defined by a power plant and an aerospace factory, this brownfield waterfront is ripe for redevelopment in the U.S.-Mexico border region of 6.5 million people. The location is about a 15-minute drive from the busiest land border crossing in the western hemisphere. More than 100,000 people cross the San Diego-Tijuana, Mexico, border every day. Thus, the project site can target a market that includes U.S. citizens, Mexican nationals, and travelers using airports in San Diego and Tijuana.

Originally published by Marta Soncodi for NAIOP's Spring 2021 Issue.

Investing in smart building technology may not be seen as a priority after commercial real estate investments were hit especially hard in 2020. However, if improving tenant experience was being considered before the pandemic, it’s now an imperative.

Why should commercial real estate owners consider investing in smart building technology upgrades? Based on research and industry analysis, fully integrated smart systems can increase building efficiency, optimize facility operations, improve occupant safety, security and wellbeing, and enhance end-user preferences. And, in light of the pandemic, stakeholders — commercial real estate companies, building owners, managers, and tenants — should examine the competitive advantages of smart building technology.

Originally published by Pat Fogleman, Executive Director of NAIOP North Carolina on August 25, 2020.

NAIOP North Carolina comprised of NAIOP Charlotte, NAIOP Piedmont Triad, and NAIOP Raleigh Durham, is recognizing our 2020 project winners. NAIOP is proud to recognize projects that positively influence our communities and industry in North Carolina.

The winning projects will be officially announced during an upcoming NAIOP NC webinar this September. The award presentation was initially scheduled to be held at the 2020 NAIOP NC conference at Pinehurst in March but due to COVID-19 the conference has been rescheduled to March 2021 at which time we will again recognize our 2020 winners along with our 2021 winners.

Originally published in NAIOP's Summer 2020 Issue by Ed Kimek, AIA, NCARB

Commerce was changing before the outbreak of COVID-19, from the exponential trajectory of e-commerce, to the growth in consumer demand for more immediate goods, to the rise of urban industrial development to fulfill last-mile needs.

The unknowns of this novel virus have accelerated that change to a tipping point. The structures of commerce, and the development that supports it, may be altered for good. This crisis is proving the necessity of a resilient supply chain.

The National Forums program brings together industry professionals in select groups to share industry knowledge, develop successful business strategies and build strong relationships in a confidential and non-competitive setting. Learn more about this unique opportunity and apply for appointment today.

The Forums provide a unique opportunity for members to openly discuss project challenges, business opportunities and lessons-learned in a confidential and non-competitive setting. Over time, fellow members become a trusted circle of advisors.

The National Forums are an excellent way to become involved, stay in touch and develop new connections with key industry leaders.

Originally published on June 5, 2020 by Shawn Moura, Ph.D.

The coronavirus pandemic has accelerated social and economic changes that were underway before the outbreak, while also leading consumers, workers and employers to adopt new preferences and behaviors. Collectively, these changes will require that commercial real estate firms adopt new approaches to design, customer relations and business operations to be successful in the future. Christopher Lee, founder and CEO of CEL & Associates, offered his predictions for how the outbreak will reshape demand for commercial real estate in the U.S. and outlined steps that firms can take to remain competitive during a recent NAIOP webinar.

Lee observed that the commercial real estate market is currently about halfway through a downturn. Although the Federal Reserve’s intervention in credit markets and fiscal stimulus measures have mitigated some of the outbreak’s effects on the economy, “all of that is going to burn off fairly soon unless another economic stimulus comes forward.” Substantial economic uncertainty and fears about the coronavirus have paralyzed decision-making in most markets. Buyers are concerned about the pandemic’s effects on building revenues and expenses as well as potential liabilities from infections, and some may no longer be able to secure favorable financing for an acquisition. Sellers are uncertain whether they should sell now or wait out the pandemic, and are unsure whether they will have good options for investing the proceeds of a sale.