Posted on June 19, 2018

Years ago, the key to attracting and retaining a talented workforce was to relax the rules a bit: Casual Fridays, flexible work hours and teleworking were the employee perks du jour.

Posted on June 19, 2018

Years ago, the key to attracting and retaining a talented workforce was to relax the rules a bit: Casual Fridays, flexible work hours and teleworking were the employee perks du jour.

Posted on June 15, 2018

The U.S. Census’ newest population estimates reveal that eight out of the 15 U.S. cities with the largest population gains are in the south, with three of the top five located in Texas. San Antonio topped the list with an increase of just over 24,000 people between 2016 and 2017. Some of the other cities with the largest population gains were Phoenix, Arizona (24,000); Dallas, Texas (18,900); Fort Worth, Texas (18,700); Los Angeles, California (18,600); Seattle, Washington (17,500); and Charlotte, North Carolina (15,600). Fort Worth, Texas, surpassed Indianapolis, Indiana, to become the fifteenth-largest city in the U.S., with a population of 874,168. The list of the top 14 largest U.S. cities has not changed since 2016.

Posted on June 11, 2018

According to a new Cushman and Wakefield report, Space Matters: Key Office Trends and Metrics, two important trends in office space include technology amenities and parking. Common amenities – such as fitness centers and cost-effective food options – remain very important but there is ample opportunity for growth in how technology-related amenities are leveraged by occupiers and landlords. Despite advances in technology, researchers found many office building owners continue to struggle with some of the most basic offerings such as seamless, high-speed internet and cellular service.

Posted on May 31, 2018

The NAIOP Research Foundation has published the NAIOP Office Space Demand Forecast for Q2 2018.

Posted on May 24, 2018

According to Cushman and Wakefield’s first quarter report on shopping centers, the retail sector will continue to struggle despite a strong economy. However, it’s not all bad news – while stores found in malls and power centers (e.g., electronics, department, sporting goods) will continue to decline, other sectors will expand, such as dollar stores, discount grocery, off-price apparel, beauty/cosmetics, fitness/health clubs, fast food, coffee and fast fashion, most of which operate in neighborhood and community centers. According to the report, these trends could benefit the owners of Class A malls. "Anchor closures at trophy or Class A malls present opportunities for landlords to attract new, more relevant tenants such as food halls, experiential concepts or other trendy new retailers at current rents," the report states. "Landlords will also see non-traditional mall tenants such as discounters, off-price or grocery chains move into some of these vacancies."

Posted on May 2, 2018

By Jennifer Lefurgy, PhD

Posted on April 20, 2018

The Net Lease Research Report by National Real Estate Investor (NREI) finds the single-tenant net lease sector will remain "in solid shape for the foreseeable future, even in what many are viewing as the late stages of the current real estate cycle." The results were compiled from 490 responses from a February survey of NREI readers; about half of the respondents held the titles of owner, partner, president, chairman, CEO or CFO. Sixty-three percent of survey participants expect cap rates for net lease properties to increase over the next 12 months. Debt and capital equity are also expected to remain as available as they have in the previous two years. The industrial and medical office sectors are predicted to drive the strongest demand over the next year. Respondents commented that there are "diamonds in the rough in secondary/tertiary markets," and the influx of German stores Lidl and Aldi will create investment opportunities. Dollar stores, largely protected from the rise of e-commerce, have "become a popular bet for some net lease investors."

Posted on April 12, 2018

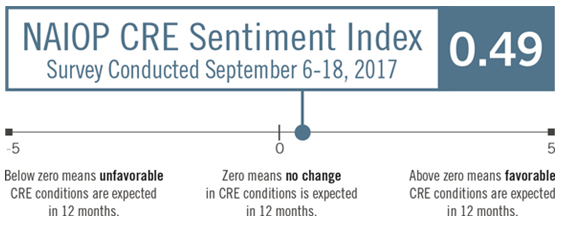

The NAIOP Sentiment Index is designed to predict general conditions in the commercial real estate industry over the next 12 months. The forecast is not based on an analysis of historical data, but rather it represents a look into the future by real estate developers, investors and operators. These NAIOP members are asked to respond to questions based on their ongoing work, including projects in their pipelines. For more information, see Understanding the Index.

Posted on March 26, 2018

By Dr. Stephen S. Fuller

Posted on March 21, 2018

By Ioana Neamt

Posted on March 20, 2018

Recruiting and retaining top performers has become essential in today's highly competitive marketplace. It's not too late to find out if your salary and bonus package is competitive with the 2017 NAIOP/CEL Commercial Real Estate Compensation and Benefits Report.

Posted on March 14, 2018

By: Dr. Stephen S. Fuller

Posted on March 9, 2018

By: Dr. Joshua Harris

Posted on February 21, 2018

By: Richard B. Peiser, Ph.D. and Raymond G. Torto, Ph.D.

Posted on January 17, 2018

Analysis by Reis, Inc. shows the U.S. office market in 2017 experienced a slowdown in tenant expansions while supply growth stayed at about the same level as in 2016. As reported in the Wall Street Journal, the survey of 79 metropolitan areas revealed that net absorption at the end of 2017 was at its lowest since 2012. In 2017, developers added 37.6 million square feet, only 1 million square feet more than in 2016, which may mitigate slower absorption rates. Vacancy increased during the fourth quarter of 2017 in 33 of the 79 markets, with New York having the lowest (8.7 percent) and Dayton, Ohio, the highest (27 percent). According to the report, growth in absorption has been falling in part because tenants have become more efficient in how they use their space, eliminating private offices and encouraging employees to work closer together. The report stated, “office-based industries are healthy, but tenants have persisted in curbing overall leasing patterns.”

View the current NAIOP Office Space Demand Forecast.

Posted on November 29, 2017

According to Dodge Data & Analytics’ 2018 Construction Outlook, construction starts will climb 3 percent to $765 billion in 2018. The growth of the construction industry will continue into 2018, but some product types, such as multifamily housing and hotels, will see less activity. Single-family housing, office building, warehouse, transportation terminal, school and health care facility construction will continue to grow during 2018.

Posted on November 28, 2017

Posted on November 16, 2017

To create destinations that captivate shoppers beyond mere retail purchases, owners have dramatically transformed malls by investing more than $8 billion in renovations over the last three years. JLL’s new report, A New Mall Rises, explores 90 super regional and regional malls that are currently undergoing or have gone through a significant renovation during that time period.

Posted on November 15, 2017

The U.S. commercial real estate industry ecosystem is changing at a rapid rate due to new forms of technology (e.g., artificial intelligence, smart cities, mobility improvements, sensors) and demographic changes in the workforce, according to Deloitte’s Commercial Real Estate Outlook 2018. The report urges the real estate industry to embrace these changes even though they might represent uncertainty.

Posted on November 13, 2017

Miss CRE's premier event? We've got you covered with the conference session recordings, recaps and news coverage you need on the CRE.Converge resources page.