Posted June 6, 2019

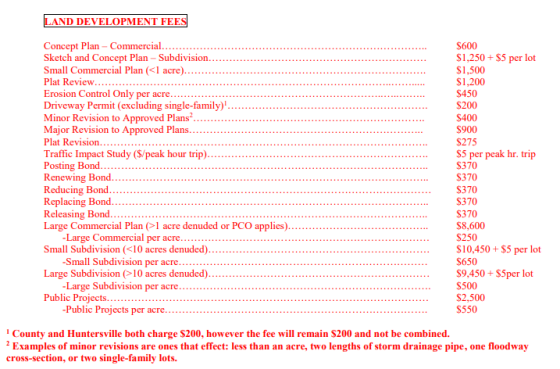

As it prepares to take over development plan review from Mecklenburg County on July 1st, the Town of Huntersville has amended its fee schedule to include the current (FY 2018) LUESA fees for land development plan review, bond maintenance and other related services. The fees are substantially lower than those proposed by Mecklenburg County in FY 2019 and 2020, which will increase more than 200% over a two-year period.

The main services the Town will take over from LUESA include development plan review; zoning, development and erosion control inspections; and bond administration. Five new positions have been created to provide these services, and the Town expects to have them in place within the next two months. The positions include a Street Inspector, an Erosion Control Inspector, a Bond Administrator, a Stormwater Plan Review and a Zoning Inspector.

The Charlotte City Council will vote next Monday night on the new

The Charlotte City Council will vote next Monday night on the new